It is easy to explain why countries with rampant corruption tend to have poor economic performance: corrupt officials steal funds from the economy and steer resources to easy-to-corrupt, wasteful projects. However, it is not easy to explain why some countries achieve high economic growth despite corruption. We offer an explanation: a high level of trust between bribe payers (e.g., business people) and bribe-takers (e.g., corrupt officials) can make corruption less harmful or even efficiency-enhancing to the economy. Here is the logic:

Society A has a high level of trust, and Society B has an extremely low level of trust. In Society A, corrupt officials feel safe to take bribes from almost anyone, including strangers, because the briber would not turn them in. Furthermore, it does not matter whether the briber pays first or whether the bribee delivers the government project first. So logically, this bribery and corruption relationship can reach a broad “bribery market” and thus become efficient. A corrupt official can solicit bids from many potential bribers and can sell his power to award the lucrative projects he controls. Logically, the briber who pays the highest bribe tends to be the most efficient project developer with the lowest cost, making corruption efficiency-enhancing.

In contrast, in Society B, the corrupt official trusts no one outside of his family, but he is powerful, and he controls many public resources. There are two ways in which he can enrich himself in this low trust society: he can give lucrative projects to his family members, who may not know how to complete them, therefore wasting public resources, or he can impose high fees and taxes on the people and the firms in the society and steal the proceeds from the state coffers. Either way, his corrupt act is pure extortion, a dead weight on the economy.

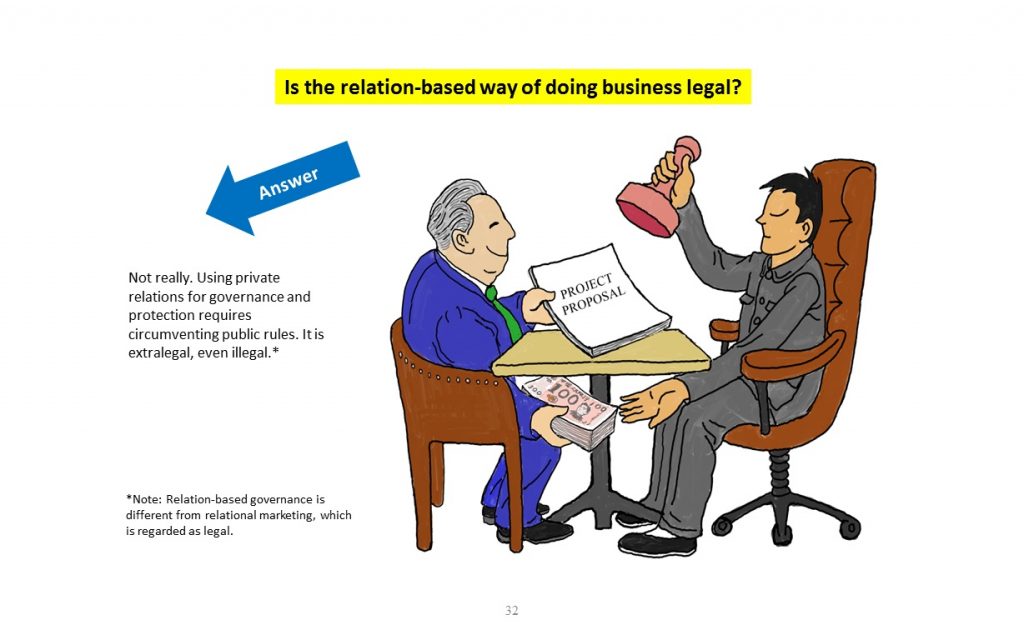

What kind of societies have both a high level of trust and a high level of corruption? Societies that do not have strong rule of law and rely on an extensive private relationship (such as “guanxi” in China) meet these two conditions. Due to the concentration of power, the corruption level is high in China (Corruption Perception Index=3.1 in year 2000 (1=most corrupt, 10=least corrupt). Due to its guanxi culture, the level of trust between friends is high (54.4% trust level in 1999-2004, 0=lowest, 100=highest). Businesspeople can be introduced through a friend and a friend’s friend to the right official who controls the project they want to have. Due to the lack of the rule of law in China, all successful business people must rely on private networks to do business, making them loyal to their friends, minimizing cheating between briber and bribee. So, the powerful official feels safe to award the project to the highest bribe payer, who, ceteris paribus, tends to be the most efficient developer of the project. This is why China has been growing fast, even though corruption is high. From 1990 to 2000, China’s economy grew 10.3% annually.

If a society has a high level of corruption and a low level of trust, then the economy tends to be dragged down by corruption. A good case of such a society is the Philippines. Like China, the Philippines has a high level of corruption (Corruption Perception Index=2.8 in year 2000). But unlike China, the Philippines does not have a strong culture of guanxi (8.6% trust level in 1999-2004). The lack of an extensive private network makes taking bribes from a stranger very risky. Thus, as shown in Society B, powerful Filipino politicians such as the late president Ferdinand Marcos and his cronies, who did not trust any outside business people who might be efficient, simply imposed fees on all businesses and stole from the state coffers, making corruption a pure deadweight on the economy. From 1990-2000, the Philippines’ economy grew 3.3% per annum.

While corruption is more efficiency-enhancing in China than in the Philippines, it is still bad for the society because the corrupt officials still take the much-needed resource from the society into their pockets, and the relatively lower risk in taking bribes encourages officials to control more aspects of the economy so that they can extort more bribes. Finally, the close collusion between businesspeople and officials makes corruption hard to detect and eradicate.

Latest Comments

Have your say!